Racing Report: November 2024

By Richard Wayman, BHA Director of Racing

In January, we’ll publish a review at the halfway stage of our two-year trial of changes to the fixture list designed to support the sport’s appeal to customers. At the outset of the trial, we set twelve targets and the review will provide an update on how things have gone in relation to each of those. That seems certain to provide a mixed picture, but more of that next month.

In the meantime, we can publish the latest racing data report, covering the first 11 months of 2024 and in this month’s blog, I am going to focus on two elements within that report.

I’ll begin with our aim to improve the competitiveness of racing during 2024. You may recall that involved scheduling 300 fewer Jump races and moving a significant number of Flat races from summer into autumn.

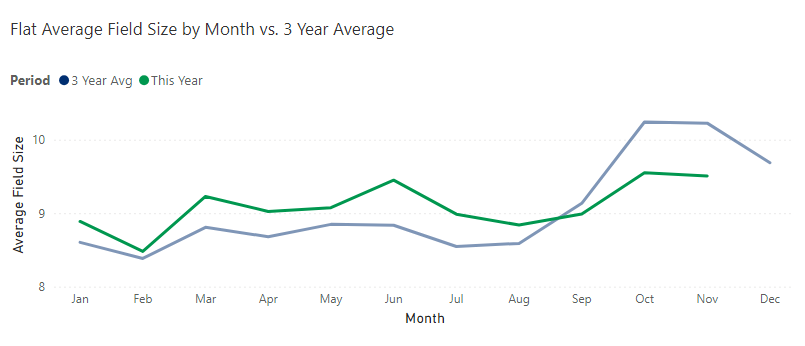

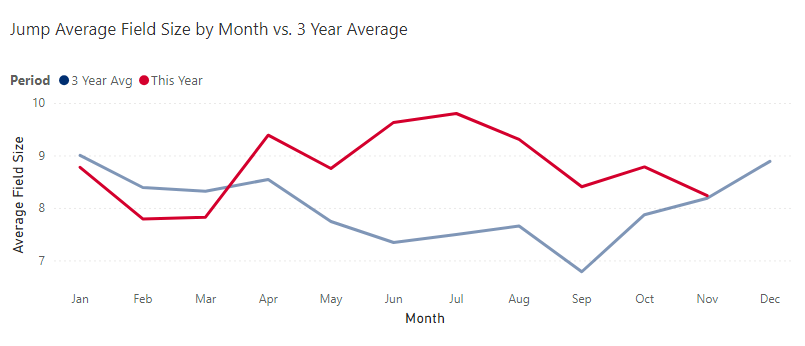

The headline field sizes numbers are included in the racing data report and show that average field sizes on the Flat (both Premier and Core) are at their highest in recent years. That is also the case for Core Jumping, although the average field sizes at Premier Jump fixtures are below their 2023 levels. More of that later in this blog.

My colleagues in the BHA Racing Department have worked with racecourses to make changes to the make-up of the race programme and better spread races across the year to support the delivery of more competitive racing for the sport’s fans. The latter has involved modelling the forecast number of runners through the year and then adjusting the volume of races to support field sizes.

The graphs below illustrate that, for both codes, this has delivered more consistently competitive racing. The graph below shows field sizes on the Flat with the blue line representing 3-year average field sizes across the year (2021-2023), with fields dipping in the summer and then growing sharply in the autumn. In 2024, however, we have been able to consistently deliver better field sizes, with the green line generally higher and less variable than has previously been the case.

There has also been improvement over Jumps with the average field sizes in 2024 illustrated in the graph below by the red line, consistently above the three-year average, represented by the blue line. The table also shows, however, the significance of ground conditions. The lower field sizes in the first three months of the year, when conditions were very wet and 78% of fixtures were run on soft or heavy ground compared with the three-year average of 48%, are a reminder that the elements will continue to have a massive influence on when and where horses will run, especially over obstacles. This will, of course, have had an impact on the average field sizes at Premier Jump fixtures, many of which are staged in the first quarter of the year.

Turning to one other area within the racing data report, I have said in previous blogs that the decline in highly quality Jump horses running in Britain is probably the most concerning of all the numbers that we report on each month.

The number of the horses that have achieved a performance figure of 130 or more in at least one race during the year has been in decline for some time and, compared with last year, there has been a reduction of 11.5%, from 729 to 645.

There will be a number of factors contributing to this worrying trend, including a much smaller number of Flat horses going Jumping as more are exported or running on the all-weather through the winter, the increasing commercial challenges associated with breeding Jump horses, changes to profile of racehorse owners with fewer sole owners and owner breeders, an increased concentration of higher quality horses in fewer pairs of hands both in Britain and Ireland, and the realignment of the handicapping file that, generally speaking, has lowered handicap ratings.

Working with various partners across the sport, several measures have been introduced in recent years that have sought to support Jumping, including:

- Changes to the Pattern and Listed Jump programme to help strengthen the upper tier of the programme, with races repositioned and, in some cases, removed entirely where other similar opportunities exist.

- The creation of Jump Premier Racedays has strengthened race programmes and increased prize money at these fixtures (up £2.5m in 2024).

- A long-term strategy over the past decade to grow the appeal of having a Jump mare in training, with the strategy particularly focussed on increasing the number of quality mares.

- Led by the TBA and with the support of the Levy Board, the creation of the Great British Bonus to encourage the breeding, buying and owning of fillies. Following the recent extension of GBB (which will boost payments to steeplechasing mares), this is forecast to lead to Jump bonuses of around £1.5m in 2025.

- Complementing the Great British Bonus, the Elite Mares Scheme is punching above its weight and encouraging the retention of quality Jump mares for breeding purposes.

- The creation of Junior National Hunt Hurdle races with the aim of supporting the development of young Jump horses and, where appropriate, encouraging more of those horses to run over obstacles at earlier stage in their careers.

There has clearly been no lack of activity, but we have to acknowledge that these measures haven’t been enough to halt the decline in the number of quality Jump horses. Bringing an end and, indeed, reversing that trend is something that is very high on our list of future targets and, therefore, not surprisingly the subject of ongoing work.

That will take time and require action on several fronts. However, with patience, perseverance and a collected effort across the sport, we are confident that we will turn this trend around and can look forward to seeing increasing numbers of quality horses in action over obstacles on British racecourses in the years to come.